Popular Posts

How To Become A Stock Trader - 6 Stages Of Development As A Share Market Trader, Trading For A Living – A Practical idea?,How to use the market calls table, Simple Money Management Rules For Online Stock Trading, Buy Only and Sell Only Watch List, How do I calculate Stop and Reverse (SAR) Level ?, How to avoid whipsaws in trading, Inspirational Quotes - For Good And Bad Times, Elliott wave pattern - Impulse (IM), Internal structure, Rules and Guidelines, Diagonal [Leading (LD) and Ending (ED)],Zigzag (ZZ), Double Zigzag (DZ), Triple Zigzag (TZ), Flat (FL), Double Sideways (D3), Triple Sideways (T3), Triangle [Contracting (CT) and Expanding (ET)], Download - Elliott Wave Calculator,Free online Black Scholes option value and option greeks calculator,Free Download - Position Sizing Calculator For Stocks, Commodity And Forex Trading Using Microsoft Excel, Stock screener based on comparative relative strength indicator method, How to filter stock's information, to get the data for your portfolio scrips, Calculating Compound Annual Growth Rate (CAGR) for investment, Stock Scan setup using Narrow Range Seven (NR7) Strategy, Average True Range (ATR) Indicator Calculator Excel Sheet, Pivot Point, Support and Resistance Calculator for Intraday Trading, Relative Strength Index (RSI), Fibonacci Extension, Fibonacci Retracement, Compounding Calculator, Simple and Exponential moving average in Excel, DJIA Today [FREE DOW FUTURES LIVE CHART] Price Rate

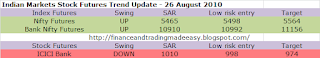

All levels as per September's contract

ReplyDeleteHi Anuj,

ReplyDeleteI read about how you calculate SAR!! Could you tell me how you calculate swings?

Thanks

Shazia

Good Morning Anuj!

ReplyDeleteScript to watch today : Infosys, DLF, Bhel, Hindalco, Kotak Bank, TataMotors, Tisco, Sail, Biocon, JPAsso, Reliance, Rcom

ReplyDeletehttp://www.4shared.com/document/LTVMdKz7/MySAR_A__Future_for_26th_Aug_.html

@rm

ReplyDeleteGood morning G

@Shazia

Well it's simple...when your SAR triggers the swing direction changes...check yesterday's levels for ICICI bank and compare it with it's chart

Another way is to see it visually and establishing a bias.You last mentioned about your interest in Tatamotors

Check the following link for Tatamotors Futures

http://in.quote.com/global/futures/chart.action?s=TATAMOTORS+U0-NSF&chartUi.period=V&chartUi.bardensity=HIGH&chartUi.studies=EMA(26,26,26);MA(78,78,78);RSI(14);&chartUi.bartype=CANDLE&chartUi.size=650x450&chartUi.minutes=15&ref=300

Observe the bearish crossover on 20th august

that's just one method..you can establish your own ways as well...That can be used to establish a bias and then finding an appropriate price level to enter with a stop...leave the rest to markets.

you should also combine it with money management

A simple rule like not to short a stock thats making 52 high and not to be long in a stock making 52 week low can keep you with trend and momentum...

Try it

Cheers

Hi,

ReplyDeleteI think you misunderstood my question.. I wanted to know how you get the swing targets.. after SAR is hit the trend changes for eg for Tata motors the SAR was 1025 and now the trend is down.. (correct me if i am wrong.. i want to learn swings)

so now what could be the target for this down trend .. i assume the first is already hit which i think was around 990!! right?

Appreciate your quick response always

Thanks

Shazia

@Shazia

ReplyDeleteFor any kind of targets the best and a simple way to use trend channels