5 Minutes Live Futures Chart - Stock Index DJIA Now

1 Hour Live Futures Graph - Dow Jones Industrial Average Today

Daily Time Frame Live Futures Candlesticks Chart - Dow 30 Today

Charts courtesy Finviz

Top 10 Interesting Facts About Dow Jones Industrial Average

1) The Dow Jones Industrial Average often referred as DJIA, the Industrial Average, the Dow Jones, the Dow Jones Industrial, DJI, the Dow 30, or simply the Dow.

2) It was created by Wall Street Journal editor Charles Dow. It is named after Dow and one of his business associates, statistician Edward Jones.

3) The industrial average was first calculated on May 26, 1896 (based date) with 40.94 as base value.

4) It is the second oldest U.S. market index after the Dow Jones Transportation Average, which was also created by Dow.

5) The Dow Jones Industrial Average (DJIA) is a price-weighted index that is calculated by dividing the sum of the prices of the 30 component stocks (Dow Jones Industrial Average components) by a number called the DJIA Divisor or Dow Divisor.

6) Its objective is to represent large and well-known U.S. companies. It covers all industries with the exception of transportation and utilities.

7) The components of the DJIA have changed 53 times in its history. General Electric has had the longest continuous presence on the index, it was added in the index in 1907.

8) Of the original 12 industrials, only General Electric currently remains part of that index. In 1928, the components of the Dow were increased to 30 stocks.

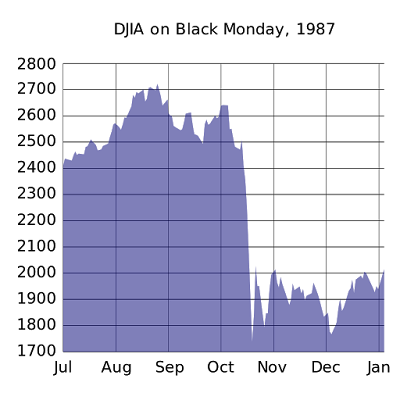

9) The largest one-day percentage drop occurred on Black Monday; October 19, 1987, when the average fell 22.61% from about the 2,500 level to around 1,750. Two days later, it rose 10.15% above the 2,000 level for a mild recovery attempt.

10) The calculation frequency of the index is every 2 seconds during U.S. stock exchange trading hours

Dow Jones Historical Graph since inception

DJIA has a 5.24% compounded annual growth rate since inception!

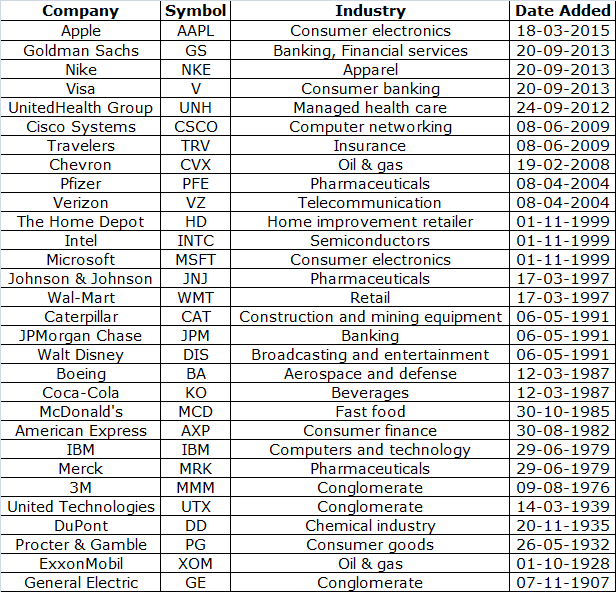

Dow 30 Components - Top 30 Companies, exchange traded symbols, along with the industries and the date they were included in DJIA.

Analysis of Dow Jones Industrial Average components

Only 5 companies out of 30 are part of index for more than 40 years.

- 15 new companies i.e half of index has been added in last 18 years.

- Apple has been included in the year 2015 while General Electric has been part of Dow 30 for about 108 years!

- Businesses need to continuously evolve and innovate to cater to the needs of economy. Very few businesses are able to sustain and survive with ever increasing competition over the period of time.

How is the Dow Jones Industrial Average (DJIA) Calculated?

The Dow Jones Industrial Average (DJIA) is a price-weighted index that is calculated by dividing the sum of the prices of the 30 component stocks (Dow Jones Industrial Average components) by a number called the DJIA Divisor or Dow Divisor.

What is a price weighted index and how it is different from free-float market capitalization based index? - As explained by Investopedia

Price weighted index is a stock index in which each stock influences the index in proportion to its price per share. The value of the index is generated by adding the prices of each of the stocks in the index and dividing them by the total number of stocks. Stocks with a higher price will be given more weight and, therefore, will have a greater influence over the performance of the index.

For example, assume that an index contains only two stocks, one priced at $1 and one priced at $10. The $10 stock is weighted nine times higher than the $1 stock. Overall, this means that this index is composed of 90% of the $10 stocks and 10% of $1 stock.

In this case, a change in the value of the $1 stock will not affect the index's value by a large amount, because it makes up such a small percentage of the index.

Free-float market capitalization based index is a stock index based on free-float market capitalization methodology.

Free-float methodology market capitalization is calculated by taking the equity's price and multiplying it by the number of shares readily available in the market. Instead of using all of the shares outstanding like the full-market capitalization method, the free-float method excludes locked-in shares such as those held by promoters and governments.

Formula to calculate free-float market capitalization

Free-float market capitalization = Share price x (Number of shares outstanding - Number of lockedin shares)

The free-float method is seen as a better way of calculating market capitalization because it provides a more accurate reflection of market movements. When using a free-float methodology, the resulting market capitalization is smaller than what would result from a full-market capitalization method.

Free-float methodology has been adopted by most of the world's major indexes, like the S&P 500 index.

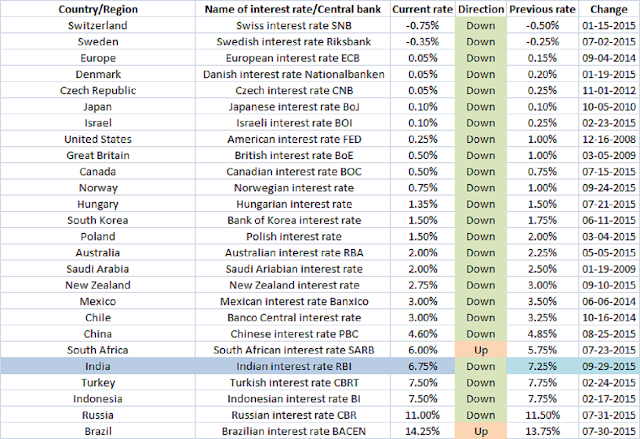

Dow Jones Stocks arranged in descending order of weightage in index

Dow Jones stock list above clearly shows how a high priced stock like Goldman Sachs gets more weight while Cisco Systems gets least weightage because it has the lowest price.

Trading and Investing in The Dow Jones Industrial Average

As DJIA is one of the most popular indices, over the years various financial products have been designed for different kinds of traders and investors. The index is tracked by an exchange-traded fund, the SPDR Dow Jones Industrial Average.

Another asset management firm, ProFunds, issue other related DJIA ETFs such as the Inverse Performance Fund for a bearish strategy on the average. That is, when the Dow trades in negative territory, the ETF trades higher, therefore it is not required to sell short, if one has a bearish goal in mind.

ProFunds also issues the 2x and 3x funds which attempt to match the daily performance of the DJIA by 200% and 300% respectively. The Inverse 2x and Inverse 3x which attempts to match the inverse daily performance by 200% and 300% respectively. In the case of 2x performance, the ETF increases the buying power by leveraging money without using margin.

In the derivatives market, futures contracts include the

E-mini Dow Futures (YM), the DJIA Futures (DJ) and the Big Dow DJIA Futures

(DD) . Options contracts with long-term expiration options called DJX LEAPS are

quite popular. There are also options on the various ETFs.

Conclusion

The above post will help in tracking the movement of Dow Jones Industrial Average in real time. Tracking the index will help to get a bird's eye view of the market sentiment, leading to better planning of trades and management of overnight open position. Questions like how DJIA is calculated and how Dow Jones stock weightage is assigned has been discussed.

If you find the above post helpful do share it with your friends on Facebook and Twitter.